The Polish Contactless Payments Market - 2011.

Issuance - Transactions - Innovations.

research report, September 2011

The report concerns the latest state of the Polish contactless payment market and presents detailed analysis of the determinants of its development. It is based on surveys carried out among all banks issuing contactless payment instruments and acquirers that operated contactless payments on the Polish market.

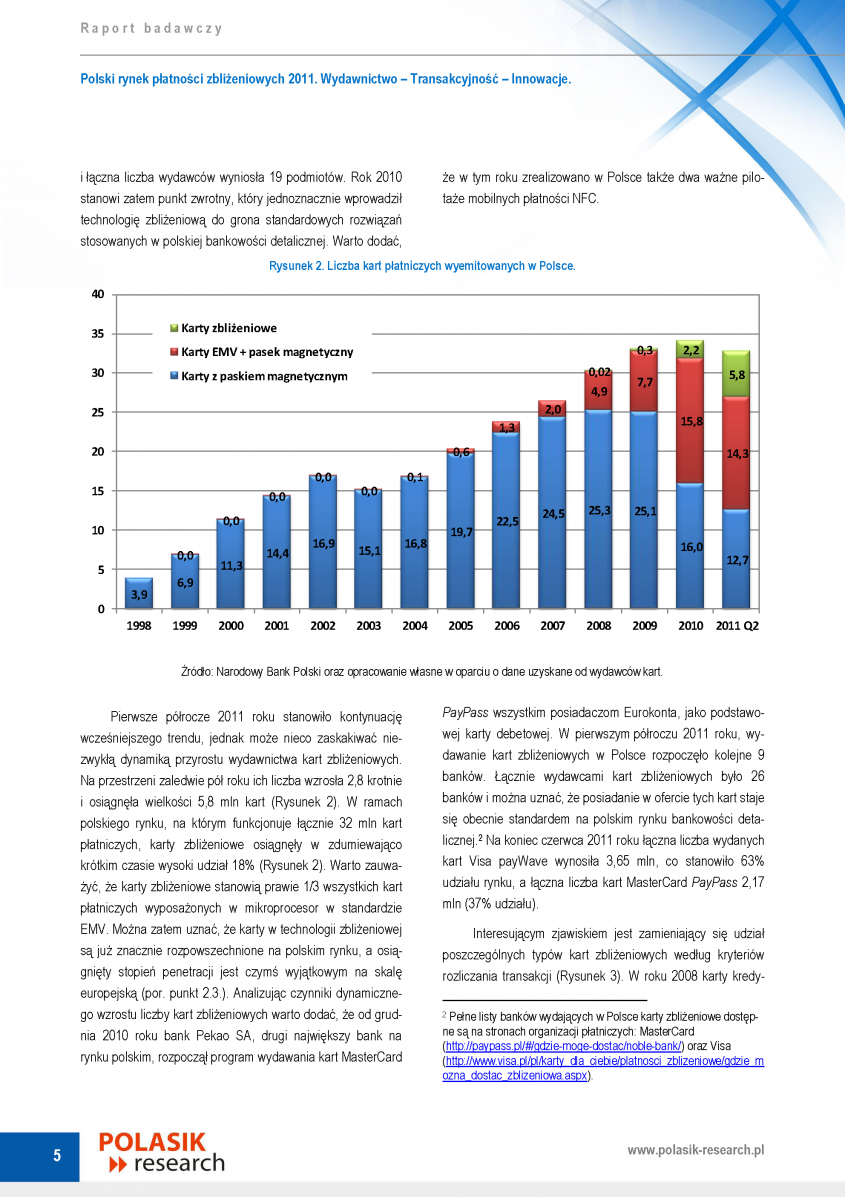

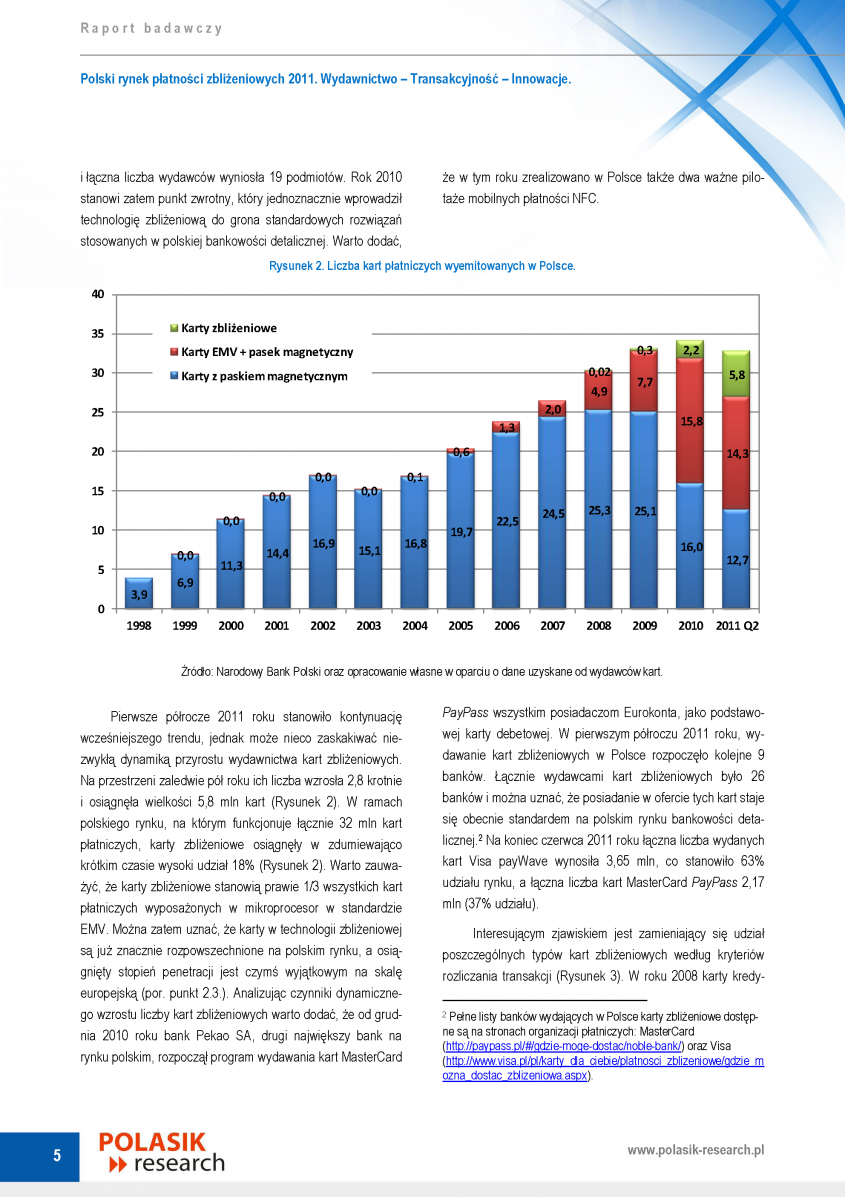

Undoubtedly, the breakthrough on the Polish contactless payment market was noticed in 2010. There was the radical acceleration in the issuance of contactless cards and the development of the acceptance network as well as the rapid growth in the number of transactions performed by customers. The first half of the 2011has brought a continuation of the dynamic growth trend. Thanks to that, the Polish market became an important example in the Europe, confirming the validity of contactless technology use as a main payment solution for the low-value transactions.

Table of contents: PDF >>

Sample pages: PDF >>

The Report:

- is 25 pages long (a two-column text),

- contains 28 charts and figures,

- presents interviews with 13 experts,

- presents data concerning the number of contactless cards and terminals as well as the number and value of contactless transactions in Poland as for 2010 and I half of the 2011,

- is based on survey. Replies were received from 14 banks (that hold 93% of all contactless cards issued in Poland) and 5 acquirers representing the entire Polish contactless POS terminals network,

- respondents answered a series of questions about factors influencing the development of the market, i.e. the activity of customers, development of acceptance network and the future of the mobile NFC payments,

- report contains forecasts for the market development.

The following companies participated in the Report:

14 banks, issuers of contactless cards, 5 acquirers, MasterCard Europe, Visa Europe, IKEA.

The Report is addressed to:

- commercial and cooperative banks,

- acquirers and card organisations,

- supermarkets and other retail chains,

- academic centres,

- public transport companies and local governments.

Report price:

The Report is sold on the basis of three licence types:

- Single User licence - This licence permits 1 user to access to the Report - price 125 EUR net *

- Institutional licence - This licence permits 20 users from the purchasing institution to access to the Report - price 300 EUR net *

- Partner licence - This licence permits 50 users from the purchasing institution and a total of 100 users representing its partners (a maximum of 50 entities) to access to the Report - price is negotiable.

* The value of the order is a net value which should be increased by the VAT if the purchaser is a VAT payer.